Why Leave Your Vessel To Chance?

Insurance is an important protection for any business activities, especially the marine sector which is growing with globalization and increase in trade.

Marine Hull Insurance protects your vessel that navigate in and out of Myanmar and covers the loss and damage of ships regularly plying domestic rivers, coaster water-ways and foreign oceans.

It also covers damages to the vessel’s hull as well as equipment within the hull.

Key Benefits

Types of Policy

. Voyage policy

. Time policy

Benefits

. Protection from total loss due to natural disasters in sea, rivers and streams.

. Protection from loss, explosion, stranding, fire damage, grounding, sinking and capsizing.

. Protection from vessels colliding with each other.

. Protection from colliding with external objects.

. Protection from loss due to captain’s wrong decision for choosing direction.

Type of Marine Hull

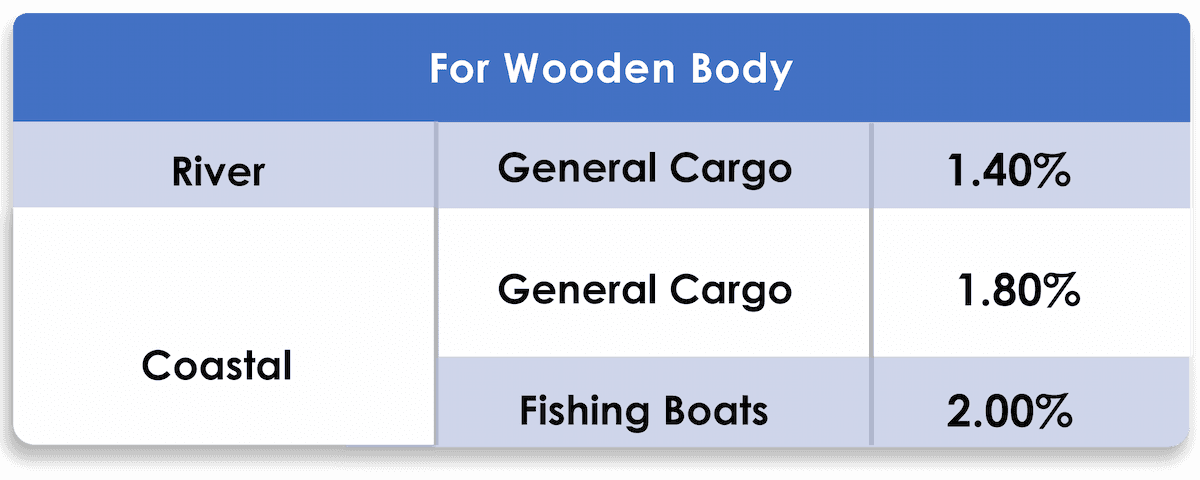

. Wooden body

. Iron body

.png&w=1920&q=75)