Food for thought

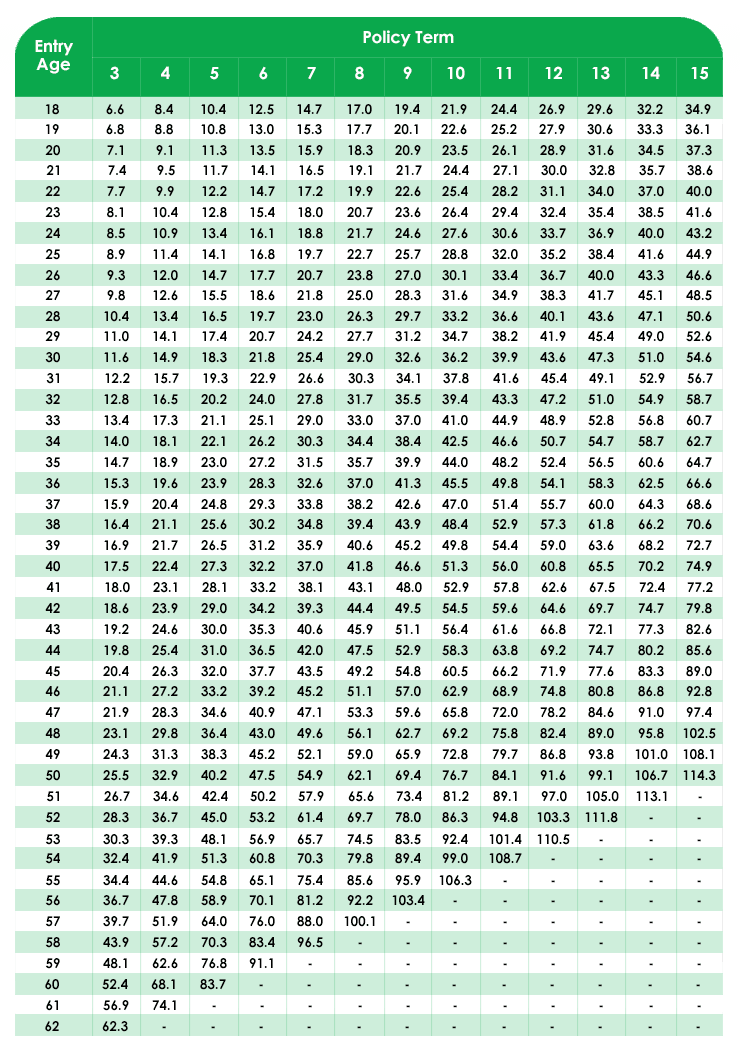

Mr. Ko, 36 years old, bought a condo for 300 million MMK. He then took up a 5 years Single Premium Credit Life Insurance and paid a one-time premium of 7.17 million MMK.

Mr. Ko passed away three years later due to and accident. With the insurance paid out from credit life insurance, the condo’s loan is paid up. Mr. Ko’s beloved can carry on their life normally without having to worry about future mortgage repayments.

Peace of mind should not come with a heavy financial burden.

Have you ever wondered how your loved ones will settle your loans and liabilities in the event of unfortunate circumstances such as death or permanent disability?

Single Premium Credit Life Insurance helps to provide financial protection to your loved ones should you encounter any unfortunate events.

Enjoy Key Benefits

Provide Peace of mind

Prevent your loved ones from financial hardship